Additionally, the cost of a comfortable retirement in Arizona is closely in line with the national average. With a warm climate in much of the state, Arizona is an attractive place for many Americans to spend their golden years.

It is important to note that these estimated costs are not a reflection of recommended retirement savings, as they do not account for any savings interest or investment income, nor do they account for retirement income, such as pensions or Social Security. Generally, states in the Northeast and the West tend to be more expensive places to retire, while those in the Midwest and South are less expensive. 'The only option to grow your money': Why new investors bought stock during the pandemicĭepending on the state, the cost of a comfortable retirement varies from as little as $858,000 to as much as $1.5 million.

#RETIREMENT LIVING EXPENSES CALCULATOR HOW TO#

Investing question: How to get started in 6 steps All data used in the ranking came from the Bureau of Economic Analysis, the Bureau of Labor Statistics, and the Institute for Health Metrics and Evaluation, an independent global health research center at the University of Washington.

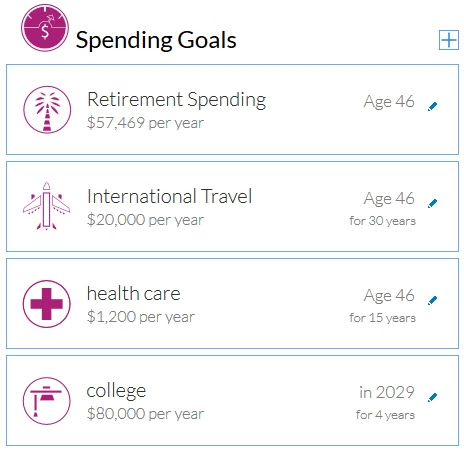

calculated what it would cost to retire comfortably in each state. Using the average annual spending of Americans 65 and older – adjusted at the state level for cost of living and life expectancy – 24/7 Wall St. As a result, the estimated cost of a comfortable retirement changes as well. Of course, cost of living varies from state to state, as does average life expectancy. Multiply those figures, and add in a little extra for unforeseen expenses and additional financial security, and a comfortable retirement costs an estimated $1,120,408 in the United States. Here is what you can do if the coronavirus is threatening your retirement.Īt age 65, Americans are expected to live an average of another 19.4 years, and the typical retirement-age American spends $50,220 a year. Despite stimulus payments and enhanced unemployment benefits, millions of Americans have reduced retirement account contributions or stopped them entirely – some have even been forced to make withdrawals. During the economic crisis brought on by the COVID-19 pandemic, that share has likely grown. View Gallery: Retirement: Each state's estimated costs for a comfortable retirementĪ 2019 report from the Federal Reserve found that nearly one in every four American adults have no retirement savings.

0 kommentar(er)

0 kommentar(er)